Cycles

“It’s cyclical.”

This statement applies to so much in our world. From interest rates to fashion trends, from climate to markets, so much of what we see, hear, do, say, and feel is cyclical.

In meeting with commercial bankers recently, here are some of the points I took special note of in the conversation:

- Many of our clients are struggling through a slow-down right now.

- Very few applications are for growth. Most are to restructure, especially in preparation for increases to interest rates.

- So many of our clients do not understand their balance sheet or how it affects their business.

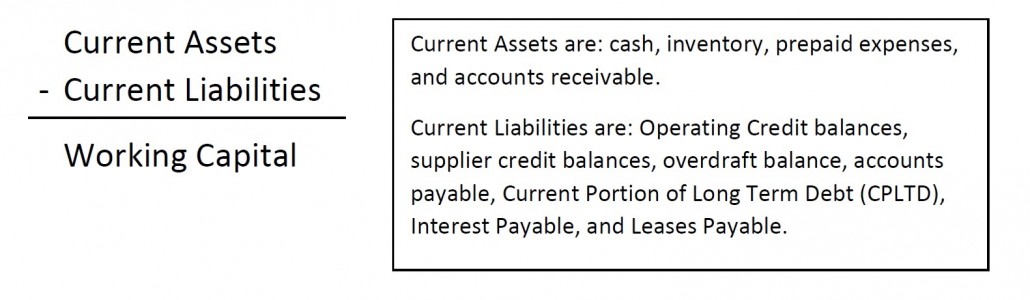

The first bullet above led to a longer portion of the total conversation. The banker who made this statement went on to describe how the boom years we have recently enjoyed led many people (entrepreneurs and employed folks alike) to create some bad habits, such as not preserving cash (working capital) and increasing their debt. When things slowed down and business got tight, the debt payments still need to be made, as does payroll, and utility bills. Somehow, the elevated lifestyle expenditures that cycled up during times of easy prosperity did not cycle back down when profitability and cash flow did.

A similar sentiment was gleaned from an ag banker (who asked to remain nameless while granting me permission to include the response below) serving North West Saskatchewan and North East Alberta. When I asked about what the trend has been in that part of the province for farm land prices and rent rates, the response included the following:

“Profitability and cashflow has been squeezed the past 3 years, due to a combination of the weather anomalies (in most cases, more moisture than needed), increase in production costs, and financing needs (and in some cases may be “wants” vs actual “needs”). Those producers/files with the stronger balance sheets and working capital positions, have fared better through this, compared to some others.”

For any of you who think that your business (or industry) is the only one to have to manage cycles, please understand that cycles are industry agnostic. The market does not care what you’ve been through, what your plans are, or what your name is. Your business plan needs to include M.O.C. – Management of Cycles.

Long time readers of my commentaries know that I have referenced Moe Russell of Panora, IA on more than one occasion. It was from Moe that I first heard the term M.O.C. – Management of Cycles. Moe tells the story of how he picked it up during a chance conversation in an airport with Matthias Grundler, the then Head of Procurement for Daimler. When asked, Grundler admitted that M.O.C. (management of cycles) was his greatest concern.

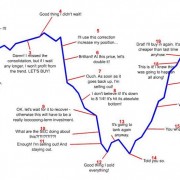

What cycle are we headed into right now? If we knew, if anyone truly knew, business would be so much easier! The risk, of course, is that we tend to get caught up in recency bias:

Recency bias occurs when people more prominently recall and emphasize recent events and observations than those in the near or distant past.

Plan for Prosperity

Trying to fight against the market cycles (or industry cycles as it may be) is like trying to fight gravity. Like it or not, it will affect you. Cycles have been happening for a lot longer than you’ve been in business, and will continue to occur long after you are gone!

“Bullet proof your balance sheet during the good times, so you can catapult ahead of your competitors during the bad times.

If you get greedy during the good times, you’ll likely be on your knees in the bad times.”Moe Russell

President, Russell Consulting Group

Look back to the response above from my ag banker colleague; those (businesses) with the stronger balance sheets and working capital…have fared better through this…” The businesses that built a balance sheet to protect them during a down cycle are the businesses that are ready, and as such will take advantage of the opportunities presented by a down cycle. Those opportunities range from additional labor (that may have been laid off from a financially weaker competitor), picking up assets (land, equipment, or buildings) that may have been relinquished during the down cycle (and are likely far cheaper now,) or possibly even buying out a competitor who has been left in a weakened state by the market cycle.

“Market cycles will hurt some, but offer opportunity to others.

The difference between who suffers and who prospers is…Who’s Ready.”– Kim Gerencser (March 2013)

Which side of that line do you want to be?