Performance Management: A Post-Harvest Checklist

With harvest done, or nearly done, across the prairies, this is the time to engage in a little retrospect.

Recognizing the window is small (and shrinking) to get all the fall work done before freeze-up, this task

may end up a notch or two down the priority list. But nonetheless, it is important to go through this

exercise now that the crop is in the bin.

1. Evaluate actual yields against expected yield

Determine why your yields did, or did not, meet expectations. Not meeting expectations could

be positive or negative, and knowing what you did to control the outcome is important to either

repeat the practice, or learn from the shortcoming.

2. Assign a value to your production

This will be a combination of the prices you’ve already contracted and the current street price

on unpriced grain. Be accurate here; it does you no good to overstate the value or quantity of

your inventory.

3. Determine your current Working Capital

Once you’ve got a value for your total grain on hand, consider the rest of your current assets

and current liabilities to determine your working capital. This is the point in each operating year

(right after harvest) where working capital should be strongest. If it currently is not, seek help.

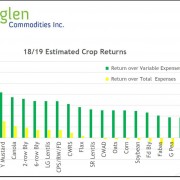

4. Production Cost and Fixed Cost Review

Looking at your whole operation as one figure does not provide sufficient information to afford

opportunity to increase management and profits. Break it down by crop and by acre. Where are

your positive points? Where are your stress points? What was your equipment cost per acre on

your cereal crops in 2015? What is your unit cost of production on that new land you rented this

year?

5. Field and Crop Analysis

Which fields were profitable? Which crops were profitable? Did you have significant variability

in some fields and/or crops? If so, how are you managing that?

6. Cash Flow Projection

Working capital versus future cash obligations gives you a clear understanding of what your cash

flow will look like over the next several months. Consider your expected cash flow in the near

term with your projections for 2016 (you will be working on those, right?) Does this affect your

expectations for next year?

7. Current Year Tax Analysis

There are less than 10 weeks remaining in the calendar year, and if your year-end matches the

calendar, you’ve got a small window of time remaining to determine what your tax situation will

look like and enact prudent business decisions accordingly.

8. Accrual Financial Statements

Whether you are incorporated or not, you should be having your accountant prepare financial

statements. If those statements have not been accrued in the past, please start now. Accrued

financial statements are the only way to truly gauge your business performance for the fiscal

year. (HINT: old statements can be accrued and presented again for management purposes.)

From the Home Quarter

One of my favorite adages is “If you don’t measure it, how can you manage it?” You’ll notice that the

essence of the points in the check list above is heavily weighted on measuring results. Any advancement

towards innovation in your business is lost if results are not accurately measured. Take the time now

that you’ve got the time to collect your data, analyze the results, and manage your performance.

Leave a Reply

Want to join the discussion?Feel free to contribute!