Valued Advisors = Service of Value

I cannot stress enough the importance of good accounting:

- I cannot stress with enough occurrences (frequency.)

- I cannot stress with enough emphasis (urgency.)

- I cannot stress with enough significance (magnitude.)

You’ve read how I feel about good accounting: you get what you pay for, and if you want to go cheap you’ll get that kind of service.

In early 2015, one of my clients had decided to move their accounting to a quality accounting firm that is

strong in ag. Previously, they were using a service that, while providing a nice financial statement (more

than just a tax preparer,) offered little in the way of consult or advice. As we are trying to move the

financial reporting to the new firm, the old service provider has been unable to clarify a “due to/due

from shareholders” line item in the statements that will have significant bearing on future tax planning.

This solidified to my clients the reasons they were moving from this “low-cost” provider to a quality

accountant in a reputable firm.

As the new firm was reconciling 2014 for my clients, it was discovered that their previous accountant

had not submitted the GST reports correctly for a number of years. The impact will be tens-of-thousands

of dollars. What other information is now suspect to scrutiny? What other ramifications might there be?

In this case, there will likely be a GST audit because the old accountant’s lack of quality work will

BENEFIT my clients to a GST REFUND of an estimated $56,000!

Direct Questions

How much more money was potentially left off the table (i.e Agri-Stability) for these clients? They’ve

come off of a string of tough years due to excess moisture.

How valuable is it to invest a few thousand more each year with a quality accountant to ensure you’re

getting accurate reporting?

Do you ask questions of your accountant, or do you accept what they say without further inquiry? Have

you discussed with your accountant your long term business plans?

From the Home Quarter

It took about 2 seconds during a phone call on Friday between my clients and their new accountants for

my clients to see that the new accountants just paid for themselves. And while a GST audit will be

uncomfortable, the future comfort (and confidence) that the reporting will be on spec and on time is of

great value. We’re all eager to see what else this new firm can find.

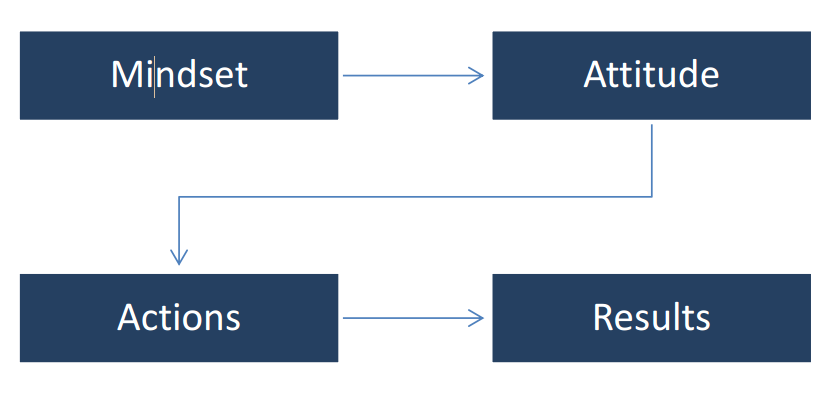

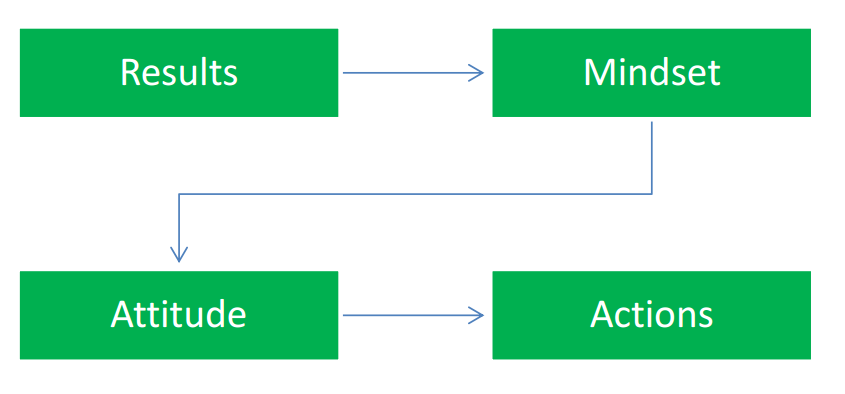

If you, as a businessperson, don’t value the financial reporting that your accountant creates, then you

will likely see accounting as an expense that you are trying to minimize. Accounting is one of those

services where you get what you pay for, and going on the cheap can be costly, as my clients will testify.

If you cheap out because you don’t value accounting, I expect your business results would reflect it.

If you’d like help planning your farm for business and personal success, then call me or send an email.